The rupee fell on Thursday, erasing earlier gains, weighed by dollar demand from local oil refiners and on continued concerns over foreign portfolio flows.

However, expectations for a rate cut from the Reserve Bank of India next week after much weaker-than-expected industrial output data bolstered stock markets, providing some support for the rupee, traders said.

Still, traders expect the rupee to remain under pressure, as a widening current account deficit and doubts about foreign capital flows keep investors on edge. A Reuters poll out on Thursday showed investors were the most pessimistic on the rupee among Asia's emerging market currencies for a third consecutive month.

"Market is nervous about continuation of FII flows especially after the budget, since flows are needed to bridge the huge current account gap. And this fear is keeping rupee under pressure," said Anil Kumar Bhansali, vice-president at Mecklai Financials.

The rupee ended at 51.5800/5850 to the dollar compared with Wednesday's close of 51.42/43. It had risen as high as 51.2950 in early trades most likely on dollar sales by some foreign banks, dealers said.

The rupee remains in a downtrend, with next support seen at the 51.64 low on Wednesday and support after that seen at 52.13, the 61.8 percent retracement from the Dec. 15 low to the Feb. 6 high.

Not all analysts are pessimistic on the rupee. Nomura said it retains its long call on the rupee, eyeing a break of 50 over the next three months, though recommending options trades to avoid the expected volatility. Nomura's strategists attributed their more optimistic view to expectations for rate cuts and an improved economic environment in India.

The one-month offshore non-deliverable forward contracts were at 51.99. In the currency futures market, the most-traded near-month dollar-rupee contracts on the National Stock Exchange, the MCX-SX and on the United Stock Exchange all ended around 51.7, on a total volume of $3.3 billion.

12 April 2012

Fertiliser - Volumes surge on anticipation of robust kharif demand; : Edelweiss PDF Link

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Visit http://indiaer.blogspot.com/ for complete details �� ��

Non-urea fertiliser sales volume surged in Q4FY12 on account of restocking by distributors ahead of the kharif season, after weak offtake during Q3FY12 fueled by poor rainfall during rabi season. Owing to the robust sales volume growth, most domestic fertiliser companies are expected to post strong revenue and profitability growth for Q4FY12 YoY. While Q1FY13 is likely to register subdued sales volume vis-à-vis Q4FY12, the outlook for FY13 is positive on account of improved availability of phosphoric acid and lower raw material prices. In the domestic fertiliser space, we remain positive on Coromandel International (Coromandel).

Strong revival in non-urea volume in February-March

While the poor post-monsoon rainfall resulted in non-urea sales volume plunging ~18% YoY during December 2011-January 2012, demand surged in February on better rainfall and restocking of distribution network for the upcoming kharif season resulted in 107% YoY sales surge during February-March. On the other hand, urea sales volume declined 1.4% YoY. The strong non-urea fertiliser sales during the quarter pacify concerns of likely inventory losses in Q1FY13 (owing to lower NBS subsidy in FY13 vis-à-vis FY12) for fertiliser companies to a great extent.

Outlook: Positive; upcoming monsoon season is key

Owing to the steep growth in fertiliser sales volume, we expect complex fertiliser companies like Coromandel, Zuari Industries (Zuari) and GSFC to post strong growth in revenue and profitability for Q4FY12 YoY. For Coromandel and Zuari, on account of the Q4FY12 sales volume being higher than our expectation, there is a likelihood of Q4FY12 numbers beating our estimates (Table 6) by 15-20%. While we expect subdued profitability from these companies during Q1FY13, on back of lower inventories being carried into FY13 and some losses on these inventories owing to lower subsidy from government in FY13 vis-à-vis FY12, the outlook for FY13 is positive. This is on account of the improved availability of raw materials like phosphoric acid and lowering of raw material costs in FY13 vis-à-vis FY12. While prospects for the fertiliser sector look bright, the key will be good monsoon in the upcoming kharif season.

In our coverage universe, we have ‘BUY’ on Coromandel and Zuari and ‘HOLD’ on Chambal. Based on DCF, we have a fair value target of INR395 for Coromandel (CMP: INR285), INR238 for Zuari (CMP: INR163) and INR84 for Chambal (CMP: INR82).

Regards,

CLICK links to Read MORE reports on:

agriculture,

Edelweiss

IIP - In weak form : Edelweiss PDF Link

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Visit http://indiaer.blogspot.com/ for complete details �� ��

IIP growth in February at ~4.1% YoY was lower than the expected ~7.0% while January’s number was revised down drastically to ~1.1% from 6.8% earlier, predominantly on account of consumer non-durables. Given the volatility and influence of base effect in IIP, we use the more stable MoM 3MMA seasonally adjusted data to assess the activity trend. On this basis, we infer that though industrial activity has emerged from an extremely weak phase, recovery is weak and fragile. Moreover, pace of expansion in February has dipped further. Going forward, for a turnaround in business cycle, policy action needs to pick up to boost business confidence besides rate cuts, which we expect to commence with a 25bps cut in April.

Industrial growth drops to 'disappointing' 4.1%, industry asks RBI to cut rates: ET

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Visit http://indiaer.blogspot.com/ for complete details �� ��

Pulled down by poor performance of manufacturing and consumer goods, industrial growth slipped to 4.1 per cent in February prompting government to state that the "disappointing" numbers will have bearing on the Reserve Bank when it takes a call on the interest rates on April 17.

Index of Industrial Production (IIP) grew by 6.7 per cent in February 2011.

Rising interest rates and poor domestic demand aggravated by global uncertainties hit the industrial investment, finance minister Pranab Mukherjee said.

What is worse, the 6.8 per cent industrial expansion in January has been drastically revised to 1.14 per cent with chief statistician TCA Anant admitting "slippages" in data collection.

Prime Minister's economic advisory council (PMEAC) chairman C Rangarajan said the government is setting up a committee to tighten sources of data gathering.

As per the IIP data released today, the growth in factory output for the cumulative April-February 2011-12 period more than halved to 3.5 per cent from 8.1 per cent from a year ago. "These (IIP) figures will have bearing on monetary policy announcement scheduled for next week. The government along with RBI will take required steps to revive activity in the economy," Mukherjee said.

Key segments like manufacturing, consumer goods, consumer durables and intermediate items, are among the worst hit. In fact, consumer durables and intermediate goods slipped into negative zones.

Planning Commission Deputy Chairman Montek Singh Ahluwalia also described the IIP figures as "very very disappointing".

Industry said decline in industrial growth is a "cause for concern" and urgent steps are needed to bring reforms back to the forefront. Industry asks RBI to cut rates

Expressing concerns over slow industrial production growth, industry today asked the Reserve Bank to cut rates in its policy review next month to boost investments and bring the growth back on track.

"Overall, industrial growth remains weak in 2011-12 and it is important to use all policy levers to encourage growth and investment. It is time that RBI focuses on getting growth back by sharply reducing interest rates," CII said.

Sharing similar views, Assocham said RBI must take this (sluggish IIP growth) into consideration, while announcing the credit policy on April 17.

Industry has been blaming the slowdown in growth to the high interest rate regime that has made borrowings costly and curbed consumer spending.

Industrial output growth slowed to 4.1 per cent in February this year, mainly due to poor performance of manufacturing sector and consumer goods segments.

"The 4.1 per cent growth in industrial output is not good enough. This may not push the cumulative growth of the sector beyond 3.5 per cent in the 2011-12 fiscal," Assocham Secretary General D S Rawat said. Output of the manufacturing sector, which constitutes over 75 per cent of the IIP, rose by just 4 per cent in February compared to 7.5 per cent in the same period last year.

"The slow growth of the manufacturing sector has got wider implications and needs to be the addressed on a priority basis," Rawat said.

Besides, the IIP growth has been revised downwards to 1.14 per cent in January from the provisional estimates of 6.8 per cent.

"The error reported in the January number has sharply pulled down the growth rate for the year till now," Rawat said.

During the April-February period of 2011-12, the IIP growth is 3.5 per cent, as against 8.1 per cent in same period in 2010-11.

Technical Report -12.04.2012- Angel Broking - PDF link

CLICK links to Read MORE reports on:

Angel Broking

Total AUM of MF Industry Declines by 13% in March '12

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Visit http://indiaer.blogspot.com/ for complete details �� ��

Total Assets Under Management (AUM) of the mutual fund (MF) industry declined by 13% (by Rs 88021 crore) to Rs 5.87 lakh crore in March 2012, the lowest AUM since June 2009. The month-on-month decline in AUM was the worst in 12 months. Except for Gold Exchange Traded Fund (ETF) whose AUM increased marginally by 0.9%, rest of the categories witnessed fall in AUM.

The decline in assets of the industry was basically due to huge outflows of Rs 76537 crore and Rs 7654 crore from Liquid and Income Funds respectively. Net outflow from the industry stood at Rs 83765 crore in March 2012, which was worst than the net inflow of Rs 1271 crore in February 2012.

AUM of equity funds declined around 2% (by Rs 3646 crore) to Rs 1.82 lakh crore due to mark-to-market losses. The equity market represented by the benchmark Nifty and Sensex fell by 1.7% and 2% respectively in March after recording gains in the previous two months. The category witnessed marginal net inflows of Rs 71 crore in March which was primarily due to inflows into Equity Linked Savings Scheme (ELSS) category.

Income funds saw net outflows for the fifth consecutive month and it was Rs 7654 crore in March. Other Exchange Traded Funds witnessed eight consecutive months of net outflows. Its net outflows stood at Rs 31 crore in March.

Gold ETF witnessed the highest net inflows in last four months. It stood at Rs 231 crore in March.

The industry registered net outflows for the second consecutive fiscal, it stood at Rs 22023 crore for the fiscal ending March 2012, as against net outflow of Rs 49406 crore for the fiscal ending March 2011.

Funds mobilized from 157 newly launched schemes in March stood at Rs 36361 crore, out of which Rs 36254 crore came from 153 close ended income funds. The number of Fixed Maturity Plans (FMPs) launched during March was higher than other months during the fiscal as investors look to invest into this product to benefit from indexation. Axis Income Fund an open ended income fund mobilized Rs 39 crore. Canara Robeco Gold Exchange Traded Fund and Motilal Oswal MOSt Shares Gold ETF (open ended Gold ETF) mobilized Rs 42 crore. SBI Tax Advantage Fund - Series II, a close ended ELSS mobilized Rs 26 crore.

CLICK links to Read MORE reports on:

mutual fund

Derivatives Report -12.04.2012- Angel Broking - PDF link

CLICK links to Read MORE reports on:

Angel Broking

Market Summary -12.04.2012- Angel Broking - PDF link

CLICK links to Read MORE reports on:

Angel Broking

Market Outlook -12.04.2012- Angel Broking - PDF link

CLICK links to Read MORE reports on:

Angel Broking

Q4FY2012 Oil & Gas earnings preview : Sharekhan Special PDF link

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Visit http://indiaer.blogspot.com/ for complete details �� ��

Q4FY2012 Oil & Gas earnings preview

Key points

|

CLICK links to Read MORE reports on:

oil and gas,

ShareKhan

Categories Turnover (BSE) (Rs. crore) Clients NRI Proprietary Trade Data

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Categories Turnover (BSE)

Visit http://indiaer.blogspot.com/ for complete details �� ��

| (Rs. crore) | |||||||||

| Clients | NRI | Proprietary | |||||||

| Trade Date | Buy | Sales | Net | Buy | Sales | Net | Buy | Sales | Net |

| 12/4/12 | 1,529.32 | 1,529.71 | -0.40 | 1.02 | 0.60 | 0.43 | 529.49 | 529.85 | -0.36 |

| 11/4/12 | 1,583.42 | 1,561.74 | 21.68 | 0.79 | 0.51 | 0.28 | 566.33 | 560.13 | 6.20 |

| 10/4/12 | 1,483.80 | 1,428.12 | 55.68 | 0.47 | 0.56 | -0.09 | 579.51 | 575.17 | 4.34 |

| Apr , 12 | 10,044.75 | 9,959.80 | 84.95 | 11.72 | 3.02 | 8.70 | 3,530.63 | 3,549.63 | -19.00 |

| Since 1/1/12 | 128,918.54 | 130,685.96 | -1,767.41 | 87.82 | 85.18 | 2.64 | 46,007.59 | 44,789.13 | 1,218.46 |

Disclaimer:

|

CLICK links to Read MORE reports on:

trading activity

DII trading activity on BSE and NSE on Capital Market

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Visit http://indiaer.blogspot.com/ for complete details �� ��

| |||||||||||||||||||||

| |||||||||||||||||||||

CLICK links to Read MORE reports on:

DII,

trading activity

FII trading activity on BSE and NSE on Capital Market

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

FII trading activity on BSE and NSE on Capital Market Segment

Visit http://indiaer.blogspot.com/ for complete details �� ��

| FII trading activity on BSE and NSE in Capital Market Segment(In Rs. Crores) | ||||||

| Category | Date | Buy Value | Sale Value | Net Value | ||

| FII | 12/4/12 | 2,030.33 | 1,894.35 | 135.98 | ||

Disclaimer:

| ||||||

CLICK links to Read MORE reports on:

FII,

trading activity

BSE, Bulk deals, 12/4/2012

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Visit http://indiaer.blogspot.com/ for complete details �� ��

| Deal Date | Scrip Code | Company | Client Name | Deal Type * | Quantity | Price ** |

| 12/4/2012 | 530027 | Aadi Inds | KFIC INVESTMENT MANAGEMENT PRIVATE LIMITED | S | 53500 | 5.00 |

| 12/4/2012 | 524448 | Ahlcon Par | SEWASTUTI FINANCE P.LTD | B | 46945 | 421.26 |

| 12/4/2012 | 524448 | Ahlcon Par | KAILASH RELAN | S | 51118 | 421.29 |

| 12/4/2012 | 531194 | Brahmaputra Infra | M L SINGHI AND ASSOCIATES PRIVATE LIMITED | S | 50000 | 48.16 |

| 12/4/2012 | 532871 | CELESTIAL | MONA HIREN SEJPAL | B | 145709 | 25.73 |

| 12/4/2012 | 532871 | CELESTIAL | SUNIL AGRAWAL | S | 141800 | 25.73 |

| 12/4/2012 | 531270 | Dazzel Conf | PARMAR SURESHBHAI P | B | 740000 | 2.86 |

| 12/4/2012 | 531270 | Dazzel Conf | VORA FINANCIAL SERVICES PRIVATE LIMITED | B | 1459817 | 2.86 |

CLICK links to Read MORE reports on:

BSE,

Bulk deals

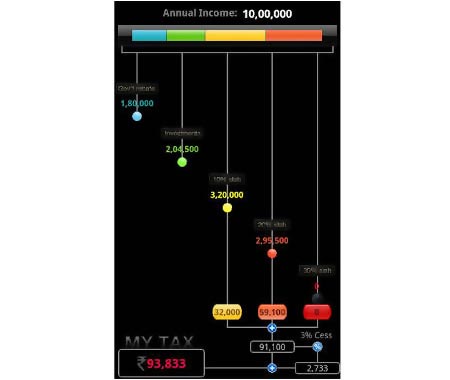

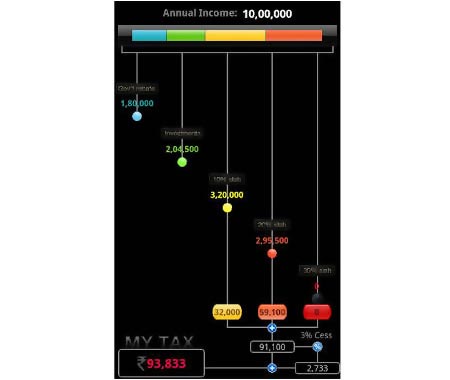

DON'T file your TAX return online before reading this

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Visit http://indiaer.blogspot.com/ for complete details �� ��

Filing income tax returns in a hurry without adequate information about the procedure could add to your woes.

It is that time of the year when one sits with a calculator or Excel sheets to calculate their earnings or various sources of income procured through the year. The sheer complexity of the procedure makes one run to a chartered accountant (CA) as everyone dreads calculations going haywire. If all this was not enough, then the huge lines at the Income Tax office where one files returns is another reason to keep away from filing income tax returns.

However, two years ago, the Income Tax department of India did a rescue act and made the whole procedure online. This was a huge relief to the taxpaying community as you could file your returns within the confines of your home, office. In fact, it could be done from any part of the country. All you need is an Internet connection. Yes, it's that simple!

However, here are a few things you should know before jumping on the online tax filing bandwagon.

NSE, Bulk deals, 12-Apr-2012

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Visit http://indiaer.blogspot.com/ for complete details �� ��

| Date | Symbol | Client Name | Buy / Sell | Quantity Traded | Wght. Avg. Price | Remarks | |

| ASSAMCO | Assam Company India Ltd | ANTIQUE HOLDING PVT LTD | BUY | 115,11,952 | 7.50 | - | |

| ASSAMCO | Assam Company India Ltd | CRESTA FUND LTD | SELL | 115,11,952 | 7.50 | - | |

| CELESTIAL | Celestial Biolabs Limited | SEJPAL MONA HIREN | BUY | 1,27,822 | 25.83 | - | |

| CELESTIAL | Celestial Biolabs Limited | SUNIL AGRAWAL | BUY | 1,000 | 25.96 | - | |

| CELESTIAL | Celestial Biolabs Limited | SUNIL AGRAWAL | SELL | 1,26,000 | 25.82 | - | |

| DENSO | Denso India Ltd | PATEL PANKAJ | SELL | 1,00,000 | 53.50 | - | |

| INVENTURE | Inventure Gro & Sec Ltd | ASHROJ CREDIT INDIA PRIVATE LIMITED | BUY | 77,155 | 316.07 | - | |

| INVENTURE | Inventure Gro & Sec Ltd | ASHROJ CREDIT INDIA PRIVATE LIMITED | SELL | 1,11,937 | 305.17 | - | |

| IVRCLINFRA | IVRCL Limited | AMRAPALI INDUSTRIES LTD. | BUY | 18,80,000 | 72.27 | - |

CLICK links to Read MORE reports on:

Bulk deals,

NSE

FII DERIVATIVES STATISTICS FOR 12-Apr-2012

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

--

Visit http://indiaer.blogspot.com/ for complete details �� ��

| FII DERIVATIVES STATISTICS FOR 12-Apr-2012 | |||||||

| BUY | SELL | OPEN INTEREST AT THE END OF THE DAY | |||||

| No. of contracts | Amt in Crores | No. of contracts | Amt in Crores | No. of contracts | Amt in Crores | ||

| INDEX FUTURES | 47598 | 1236.98 | 40322 | 1044.32 | 373396 | 9736.54 | 192.66 |

| INDEX OPTIONS | 506644 | 13315.94 | 495596 | 13038.21 | 1328839 | 35059.18 | 277.73 |

| STOCK FUTURES | 38255 | 1102.29 | 38450 | 1088.99 | 812182 | 22880.40 | 13.31 |

| STOCK OPTIONS | 25142 | 734.46 | 27767 | 816.39 | 35416 | 983.19 | -81.93 |

| Total | 401.76 | ||||||

--

CLICK links to Read MORE reports on:

derivative statistics,

FII

Subscribe to:

Posts (Atom)