Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Visit http://indiaer.blogspot.com/ for complete details �� ��

Filing income tax returns in a hurry without adequate information about the procedure could add to your woes.

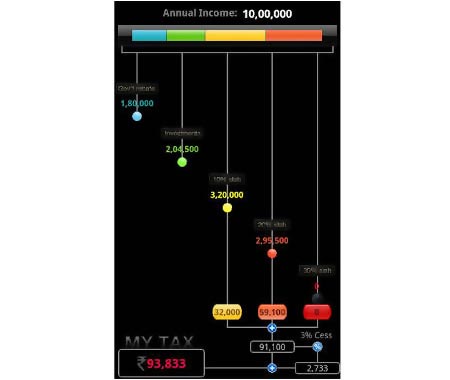

It is that time of the year when one sits with a calculator or Excel sheets to calculate their earnings or various sources of income procured through the year. The sheer complexity of the procedure makes one run to a chartered accountant (CA) as everyone dreads calculations going haywire. If all this was not enough, then the huge lines at the Income Tax office where one files returns is another reason to keep away from filing income tax returns.

However, two years ago, the Income Tax department of India did a rescue act and made the whole procedure online. This was a huge relief to the taxpaying community as you could file your returns within the confines of your home, office. In fact, it could be done from any part of the country. All you need is an Internet connection. Yes, it's that simple!

However, here are a few things you should know before jumping on the online tax filing bandwagon.

The author is chief evangelist, Perfios.com

1. PAN card

This is a no brainer that a PAN card is required to file income tax returns. By simply punching in your PAN number, some of the details get auto filled like address, contact details and more.

2. Valid e-mail ID

Though this may sound ridiculous, it is very important to have an e-mail ID which is active. As all the communications like acknowledgements are received via e-mail.

3. Opening an account

If you are filing returns online for the first time, then you have to open an account with a username and password by logging into www.incometaxindiaefiling.gov.in.

Once the account becomes active a confirmatory mail is sent on your e-mail address.

4. Download the required software

Once logged in there's Return Preparation software which has to be downloaded to fill the relevant ITR (income tax return) forms. The web site has an instruction sheet which will explain how to go about.

5. Procuring Form 16

This form is provided by your employer. It's a statement of your taxable salary, permitted deductions and tax already paid on your behalf to the Income Tax department.

In order to get hold of this, you should get in touch with the HR or the accounts department of your company.

Note: If your salary is less than Rs 5 lakh, you are exempted from filing returns.

6. Selecting from ITR 1 to 7

When you log on to www.incometaxindiaefiling.gov.in, the first step is selecting the correct IRT form. These forms are numbered from 1 to 7 each for a different category.

Example: If your only source of income is salary, interest income and/or pension then ITR 1 is to be filled.

ITR 2 is for income from house property/capital gains

ITR 3 is used for income from partnership in a firm

ITR 4 is for income from business and ITR 4S is filed for income from presumptive business

Note: Please download the Excel version of the above-mentioned forms and enable an option called 'Macros'. If not, many of the required fields do not function properly.

7. Net banking facility

Once the calculations are over, you can pay the tax amount online using the net banking facility as well. Please take care that whichever bank you choose, it should have an e-payments option.

8. Digital signature (A new concept)

A digital signature is different from an e-signature. If one fails to have a digital signature then it is mandatory that after filing the income tax returns (ITR) electronically, a physical copy (ITR V) of the same has to be mailed to a specified address on the income tax web site.

(Mailing Address: Income Tax Department – CPC, Post Bag No – 1, Electronic City Post Office, Bangalore – 560100, Karnataka)

9. Deadline

If you have to send a mail, then it should be done within 120 days from the time the process is completed. Also, special care should be taken that the printout is not folded. This is because there is a barcode which shouldn't be tampered.

If not done with in the specified time your registration with the I-T department is cancelled and your returns considered not filed.

10. Mode of mailing acknowledgement (ITR V)

The Income Tax department accepts acknowledgements received ONLY through speed post or ordinary post. Also, special care should be taken the acknowledgement sheet is signed.

The I-T department accepts ITR V only when signed by the filer.

Generally an acknowledgement for receipt of ITR V takes around 10 days. However, if no mails regarding the same appear then it would be wise to check with the IT department or resend ITR V.

Lastly, please remember that signature should be in blue ink. There have been many cases in the past where signatures in black ink were considered scanned and hence rejected!

However, if you find the Government website cumbersome then there are dedicated sites which help you save you time and sanity!

That's about it. So these days one can afford to be lazy while filing out the much-dreaded income tax returns. Happy filing!

No comments:

Post a Comment