Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Visit http://indiaer.blogspot.com/ for complete details �� ��

Finance Minister Pranab Mukherjee presented the Union Budget 2012-13 in Parliament on Friday.

While the finance minister made the tax payers slightly happy by raising the individual tax exemption limit to Rs 200,000, he made many others unhappy.

So what has been the impact of this Budget on your daily life?

1. Cars

If you plan to buy a car, be prepared to cough up more money as cars will attract ad valorem rate of 27 per cent post Budget.

Large cars' duty has been raised from 22 per cent to 24 per cent.

Luxury cars will become more expensive by up to Rs 300,000 as disappointed automakers such as Mercedes Benz and Audi deciding to pass on increased duties imposed in the Budget to consumers.

Luxury cars will become more expensive by up to Rs 300,000 as disappointed automakers such as Mercedes Benz and Audi deciding to pass on increased duties imposed in the Budget to consumers.

The premium car makers usually bring in advanced technology into the country and this step will be very counter productive, feel analysts.

2. Gold and platinum

Gold and platinum jewellery prices are set to rise post Budget as customs duty on standard gold has been raised from 2 per cent to 4 per cent.

Branded silver jewellery, however, is set to see a fall in prices as it will be fully exempted from excise duty post Budget.

3. Eating out

If you are a foodie, be careful as every visit to the restaurant now is sure to cost you more.

4. Air travel

The Budget failed to cheer those bitten by the travel bug as airfares are all set for another rise post Budget.

5. Cancer, HIV drugs

Cancer and HIV patients got a breather this Budget with the Finance Minister announcing a cut in medicine prices for these deadly diseases.

6. Solar power lamps, LED bulbs

LEDs (light-emitting diodes) to cost less. Perhaps some electronic goods that require LEDs will cost less as well.

LEDs (light-emitting diodes) to cost less. Perhaps some electronic goods that require LEDs will cost less as well.

7. Iodised salt

Fond of adding that extra teaspoon of salt to your food?

Try the iodised salt from now as this particular item is set to be cost less post Budget.

8. Cigarettes

Are you a smoker desperate to quit?

Are you a smoker desperate to quit?

Well, post Budget, kick the habit to save your health and some money as well.

For, certain cigarettes and bidis will attract higher excise duty from now.

9. Soya products

Are you a health freak, a vegeterian or allergic to lactose?

Then this Budget definitely has some good news for you.

All soya products are going to cost less post Budget.

Therefore, the next time you shed a few kilos, don't forget to thank Finance Minister Pranab Mukherjee.

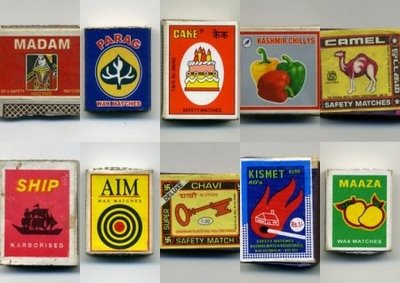

10. Matchboxes

Though the finance minister raised excise duty on certain cigarettes and bidis, matchboxes will cost less.\

11. Hotel accommodation

Budget did not bring good news for the lovers of luxury as hotel accommodation will become even more expensive after a steep hike in tax rates proposed.

12. Mobile phones

Have you been eyeing the latest mobile handset that your neighbour bought.

Here's a piece of good news for you: mobiles are set to cost less post Budget.

For, mobile phone parts will become cheaper as excise duty has been cut to 2 per cent from the existing 10 per cent.

13. Imported bicycles

Imported bicycles will become more expensive post Budget as customs duty has been hiked to 30 per cent from 10 per cent.

Imported bicycles will become more expensive post Budget as customs duty has been hiked to 30 per cent from 10 per cent.

The same for bicycle parts has been increased to 20 per cent from 10 per cent.

14. Consumer electronics

Prices of consumer electronics like LCD TV, LED TV, air-conditioners, refrigerators, washing machine and microwave ovens are going to go up by 2-4 per cent, posing a major headache for white goods companies who are fighting a slowdown in demand for the last one year.

15. Branded garments

Branded garments will become cheaper despite hike in its excise duty as a result of the government raising the abatement from 55 per cent to 70 per cent under the budgetary proposals for 2012-13.

This would mean the levy would not be imposed on 70 per cent of the cost of the product as against the present exemption of 55 per cent.

Thereby the effective excise duty would stand reduced to 3.6 per cent from 4.5 per cent.

No comments:

Post a Comment