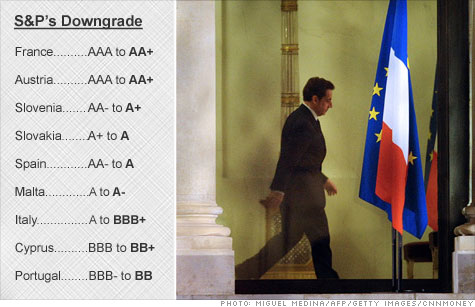

Standard & Poor's said Friday that it has downgraded the credit ratings of nine euro area governments, including AAA-rated France and Austria.

S&P lowered its rating for Italy, Spain, Portugal and Cyprus by two notches. The move means Italian bonds are now rated BBB+, dangerously close to the junk bond level that could make it even harder for the government to raise money.

France and Austria both had their top-tier credit rating lowered by one notch to AA+, said S&P. But Germany, Finland, the Netherlands and Luxembourg all maintained their AAA ratings.

S&P cut the ratings of Malta, Slovakia and Slovenia by one notch.

It's not clear how hard the downgrades will hit markets. Investors have been expecting S&P to act for weeks now -- a fact that could blunt the impact. At the same time, downgrades could scare off investors in European debt and raise the cost of government borrowing.

S&P said the downgrades reflect a combination of economic and financial challenges, as well as "an open and prolonged dispute among European policymakers over the proper approach to address challenges."

Specifically, the agency pointed to weakening economies, tightening credit conditions across the eurozone, rising interest rates for a growing number of nations and the "deleveraging" of both governments and households.

"Today's rating actions are primarily driven by our assessment that the policy initiatives that have been taken by European policymakers in recent weeks may be insufficient to fully address ongoing systemic stresses in the eurozone," said S&P.

S&P warned that most eurozone governments are at risk of further downgrades given the risk of a "more adverse economic and financial environment."

The agency said a deeper-than-expected recession in the eurozone would put further stress on government finances. In addition, governments remain vulnerable to further turmoil in the bond market, which could drive up their borrowing costs.

Meanwhile, S&P said it welcomed recent moves by the European Central Bank to help prevent a credit crisis in the banking system.

No comments:

Post a Comment