Visit http://indiaer.blogspot.com/ for complete details �� ��

06 January 2011

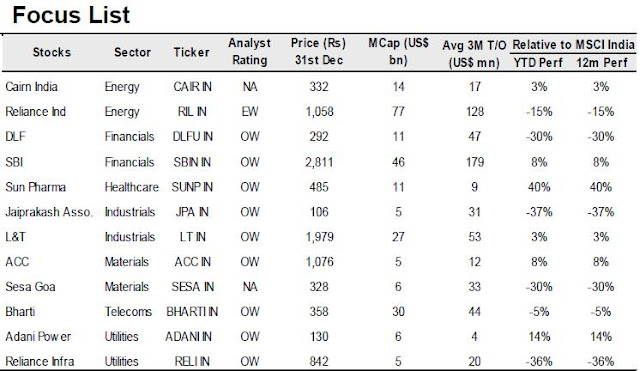

Morgan Stanley: India Strategy - A Slow Grind Up: 2011 Outlook

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Visit http://indiaer.blogspot.com/ for complete details �� ��

CLICK links to Read MORE reports on:

2011 Ideas,

Morgan Stanley Research

Anand Rathi Top Picks for 2011

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Anand Rathi Top Picks for 2011 Large Caps

Anand Rathi Top Picks for 2011 Mid Caps

Visit http://indiaer.blogspot.com/ for complete details �� ��

Anand Rathi Top Picks for 2011 Large Caps

- Axis Bank

- HDIL

- ICICI Bank

- Mphasis

- Tech Mahindra

- United Phosphorous

Anand Rathi Top Picks for 2011 Mid Caps

- Anant Raj Industries

- Blue Star

- CRISIL

- FAG Bearings

- Finolex Cables

- Greenply Industries

- Jammu & Kashmir Bank

- Surya Roshni

- TAJGVK

CLICK links to Read MORE reports on:

2011 Ideas,

anand rathi

Grey Market Premium IPO- Shekhawati, C. Mahendra, Midvalley entertainment Jan 6 2011

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Visit http://indiaer.blogspot.com/ for complete details �� ��

Company Name | Offer Price | Premium |

(Rs.) | (Rs.) | |

Shekhawati Poly Yarn | 30 (Fixed) | 0.5 to 1 |

C. Mahendra Export | 95 to 110 | 2 to 3 |

Midvalley entertainment | 64 to 70 | 4 to 5 |

CLICK links to Read MORE reports on:

gray market,

Grey market premium,

IPO

Siemens: Limited potential for upside to estimates; valuations expensive:: Kotak Securities

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Siemens (SIEM)

Industrials

Limited potential for upside to estimates; valuations expensive. Retain REDUCE as

high valuations appear unjustifiable given volatile business and limited potential for

upside to estimates. FY2010 margin expansion aided by mobility segment profitability

(likely to sustain) and high power T&D margins (unlikely to sustain -return to normalized

levels already seen in 4Q). Industrials remain weak—growth primarily led by low base.

Annual report highlights strong cash generation, lower project business revenue share.

Visit http://indiaer.blogspot.com/ for complete details �� ��

Siemens (SIEM)

Industrials

Limited potential for upside to estimates; valuations expensive. Retain REDUCE as

high valuations appear unjustifiable given volatile business and limited potential for

upside to estimates. FY2010 margin expansion aided by mobility segment profitability

(likely to sustain) and high power T&D margins (unlikely to sustain -return to normalized

levels already seen in 4Q). Industrials remain weak—growth primarily led by low base.

Annual report highlights strong cash generation, lower project business revenue share.

Gujarat Apollo: Management Meet Highlights: Kotak Securities

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

GUJARAT APOLLO LIMITED (GAL)

PRICE: RS.174

RECOMMENDATION: BUY

TARGET PRICE: RS.270

FY12E P/E: 6.8X

q NHAI has been sluggish in awarding fresh road projects vis-à-vis last

year. Pick up in NHAI and government spending is likely to spill over to

FY12. However, broader outlook for company's revenue growth remains

positive in medium to long term.

q Company is likely to report slippage in sales from FY11 to FY12 on account of elongated monsoon season this year and current slowdown in

NHAI activity for awarding new projects.

q Recently, from second half of third quarter, company has been observing

pick up in enquiries and orders from its key clients.

q We believe that the company would maintain its dominant position in

the domestic market. However we tweak our earning estimates downward to account for possible earning slippage and slight margin contraction due to increasing input prices.

q We remain positive on the road equipment sector as well as on the company and recommend 'BUY' with a one year DCF based price target of

Rs.270 (290 earlier).

Visit http://indiaer.blogspot.com/ for complete details �� ��

GUJARAT APOLLO LIMITED (GAL)

PRICE: RS.174

RECOMMENDATION: BUY

TARGET PRICE: RS.270

FY12E P/E: 6.8X

q NHAI has been sluggish in awarding fresh road projects vis-à-vis last

year. Pick up in NHAI and government spending is likely to spill over to

FY12. However, broader outlook for company's revenue growth remains

positive in medium to long term.

q Company is likely to report slippage in sales from FY11 to FY12 on account of elongated monsoon season this year and current slowdown in

NHAI activity for awarding new projects.

q Recently, from second half of third quarter, company has been observing

pick up in enquiries and orders from its key clients.

q We believe that the company would maintain its dominant position in

the domestic market. However we tweak our earning estimates downward to account for possible earning slippage and slight margin contraction due to increasing input prices.

q We remain positive on the road equipment sector as well as on the company and recommend 'BUY' with a one year DCF based price target of

Rs.270 (290 earlier).

CLICK links to Read MORE reports on:

Gujarat Apollo,

Kotak Sec

Kotak Securities: Corporate,Economy & Business News: Jan 6, 2011

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Economy News

4 Despite the volatility in global crude oil prices, the Government is trying

to prevent further increase in diesel, and cooking gasretail prices. The

Petroleum Minister, Mr Murli Deora, on Wednesday said that his Ministry

is not in favour of raising prices of these petroleum products. "We are

trying to see that there is no further price increase," the Minister told

reporters here adding that "If crude oil prices increase then something

has to be done, but we are doing our best to see that essential

commodity prices don't increase." (BL)

Visit http://indiaer.blogspot.com/ for complete details �� ��

Economy News

4 Despite the volatility in global crude oil prices, the Government is trying

to prevent further increase in diesel, and cooking gasretail prices. The

Petroleum Minister, Mr Murli Deora, on Wednesday said that his Ministry

is not in favour of raising prices of these petroleum products. "We are

trying to see that there is no further price increase," the Minister told

reporters here adding that "If crude oil prices increase then something

has to be done, but we are doing our best to see that essential

commodity prices don't increase." (BL)

CLICK links to Read MORE reports on:

Kotak Sec

FII & DII trading activity on NSE and BSE as on 06-Jan-2011

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Visit http://indiaer.blogspot.com/ for complete details �� ��

| FII trading activity on NSE and BSE on Capital Market Segment | ||||||||||||||||

| The following is combined FII trading data across NSE and BSE collated on the basis of trades executed by FIIs on 06-Jan-2011. | ||||||||||||||||

| ||||||||||||||||

| Domestic Institutional Investors trading activity on NSE and BSE on Capital Market Segment | ||||||||||||||||

| The following is combined Domestic Institutional Investors trading data across NSE and BSE collated on the basis of trades executed by Banks, DFIs, Insurance, MFs and New Pension System on 06-Jan-2011. | ||||||||||||||||

| ||||||||||||||||

CLICK links to Read MORE reports on:

DII,

FII,

trading activity

FII DERIVATIVES STATISTICS FOR 06-Jan-2011

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Visit http://indiaer.blogspot.com/ for complete details �� ��

| FII DERIVATIVES STATISTICS FOR 06-Jan-2011 | |||||||

| BUY | SELL | OPEN INTEREST AT THE END OF THE DAY | |||||

| No. of contracts | Amt in Crores | No. of contracts | Amt in Crores | No. of contracts | Amt in Crores | ||

| INDEX FUTURES | 52512 | 1593.47 | 48180 | 1462.85 | 415472 | 12511.17 | 130.62 |

| INDEX OPTIONS | 147442 | 4401.78 | 129286 | 3911.15 | 1275536 | 38382.67 | 490.63 |

| STOCK FUTURES | 44237 | 1311.01 | 61484 | 1744.84 | 1262264 | 34745.94 | -433.84 |

| STOCK OPTIONS | 11124 | 352.06 | 11868 | 374.42 | 13796 | 423.24 | -22.36 |

| Total | 165.05 | ||||||

CLICK links to Read MORE reports on:

derivative statistics,

FII

FII DERIVATIVES STATISTICS FOR 06-Jan-2011

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Visit http://indiaer.blogspot.com/ for complete details �� ��

| FII DERIVATIVES STATISTICS FOR 06-Jan-2011 | |||||||

| BUY | SELL | OPEN INTEREST AT THE END OF THE DAY | |||||

| No. of contracts | Amt in Crores | No. of contracts | Amt in Crores | No. of contracts | Amt in Crores | ||

| INDEX FUTURES | 52512 | 1593.47 | 48180 | 1462.85 | 415472 | 12511.17 | 130.62 |

| INDEX OPTIONS | 147442 | 4401.78 | 129286 | 3911.15 | 1275536 | 38382.67 | 490.63 |

| STOCK FUTURES | 44237 | 1311.01 | 61484 | 1744.84 | 1262264 | 34745.94 | -433.84 |

| STOCK OPTIONS | 11124 | 352.06 | 11868 | 374.42 | 13796 | 423.24 | -22.36 |

| Total | 165.05 | ||||||

CLICK links to Read MORE reports on:

derivative statistics,

FII

C Mahendra Exports: Oversubscribed 2.78x; QIB 1x; HNI 3.9x; Retail 4.8x

Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

C. MAHENDRA EXPORTS LIMITED

Updated as on 06 January 2011 at 1745 hrs

Visit http://indiaer.blogspot.com/ for complete details �� ��

C. MAHENDRA EXPORTS LIMITED

| Total Issue Size | 15000000 |

| Total Bids Received | 41739000 |

| Total Bids Received at Cut-off Price | 22332360 |

| No. of times issue is subscribed | 2.78 |

| Sr.No. | Category | No.of shares offered/reserved | No. of shares bid for | No. of times of total meant for the category |

| 1 | Qualified Institutional Buyers (QIBs) | 7500000 | 7623480 | 1.02 |

| 1(a) | Foreign Institutional Investors (FIIs) | 7623480 | ||

| 1(b) | Domestic Financial Institutions(Banks/ Financial Institutions(FIs)/ Insurance Companies) | 0 | ||

| 1(c) | Mutual Funds | 0 | ||

| 1(d) | Others | 0 | ||

| 2 | Non Institutional Investors | 2250000 | 8819580 | 3.92 |

| 2(a) | Corporates | 3993660 | ||

| 2(b) | Individuals (Other than RIIs) | 4735020 | ||

| 2(c) | Others | 90900 | ||

| 3 | Retail Individual Investors (RIIs) | 5250000 | 25295940 | 4.82 |

| 3(a) | Cut Off | 22332360 | ||

| 3(b) | Price Bids | 2963580 |

Updated as on 06 January 2011 at 1745 hrs

CLICK links to Read MORE reports on:

C Mahendra Exports,

IPO

Subscribe to:

Posts (Atom)