Please Share::

�� India Equity Research Reports, IPO and Stock News Visit http://indiaer.blogspot.com/ for complete details ��

��

-->

�� India Equity Research Reports, IPO and Stock News Visit http://indiaer.blogspot.com/ for complete details ��

��

Syngene International Ltd, a subsidiary of leading pharma major Biocon Ltd and India's leading contract research organization (CRO), is planning to raise Rs 550 crore from its initial public offering (IPO).

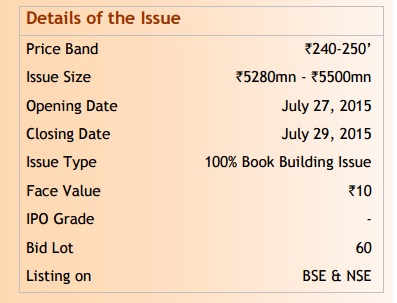

Initial share sale of Syngene International Ltd, which will open for subscription on July 27 and close on July 29, is a good bet for long-term investors, GEPL Capital said in a note.

Syngene is likely to incur capex of US $200mn in the next 2-3 years for greenfield as well as brownfield expansion. It currently manufactures small & large molecule to support clinical trials for multiple clients.

It has shown healthy financial performance in the last 5 years. During the last 5 years, revenue grew 28 per cent & EBITDA grew by 31 per cent.

In FY15, the company derived 96 per cent of revenue from the export market. In FY15, its revenue stood at Rs 8716mn and PAT at Rs 1750mn. EBITDA margin for FY15 stood at 34%.

The brokerage firm is of the view that Syngene is available at the IPO price band of Rs 240-Rs 250 which is available at 28.1 times FY15EPS. "We believe that this valuation is cheaper. So we recommend Subscribe to this IPO," said the research firm.

|

The company offers suite of integrated, end to end discovery & development service for novel molecular entities (NME's) across industrial sectors, including pharma, biotechnology, agrochemical, consumer health, animal health, cosmetics & nutrition companies.

High Growth Visibility in CRAMS business

The global R&D expenditure for the pharmaceutical industry in 2014 was approximately US$139bn, out of which US$105bn was outsourced. According to a Frost & Sullivan report, the global CRO market for drug discovery was estimated to be US$14.7 in 2014 & is expected to reach US$22.7bn in 2018.

Syngene is well poised to benefit from growth in the outsourcing market. The company has a proven track record of successful delivery, reliability, cost efficiency, client satisfaction, and this will augur well for growth in contract research and manufacturing services (CRAM) business.

Scale up of manufacturing capabilities to drive future growth

Syngene intends to evolve from a CRO into a Contract Research & Manufacturing Services organization with commercial-scale manufacturing capabilities & to provide forward integrations on the drug discovery and development continuum.

The company is likely to incur capex of US $200mn in the next 2-3 years for greenfield as well as brownfield expansion. It currently manufactures small & large molecule to support clinical trials for multiple clients.

For commercial scale manufacturing, it has entered into three long- term contracts with two existing clients for commercial manufacturing of their novel small molecule. Commercial-scale manufacturing will drive future growth.

No comments:

Post a Comment