Please Share::

�� India Equity Research Reports, IPO and Stock News Visit http://indiaer.blogspot.com/ for complete details ��

��

-->

�� India Equity Research Reports, IPO and Stock News Visit http://indiaer.blogspot.com/ for complete details ��

��

India Inc is going through a rough patch and the last quarter was no different. According to a ETIG study, the aggregate revenues and net profit of Indian listed companies fell by 5% and 15% respectively for the fourth quarter of 2014-15. Analysis based on annual results show similar results.

However, there are several companies that continue to report fabulous net profit growth year after year. So, instead of looking at companies showing bad numbers, we decided to concentrate on companies that are delivering good numbers. The companies growing fast in a difficult environment should continue to do so when the expected economic pickup happens.

How we did it

We decided to go with the stocks that are part of BSE 500 or CNX 500. The next step was to shortlist the companies that have shown 20% net profit growth every year in the last three years. Since the stock prices are based on future growth, we decided to consider that as well. The next step was to collect the expected net profit growth for the next financial year. We shortlisted companies that are expected to grow at least 20% in the next year. This data is based on consensus analyst estimate and here again we put a sanity check; at least 10 analysts must be covering that counter. Given below are those seven companies that cleared all these hurdles.

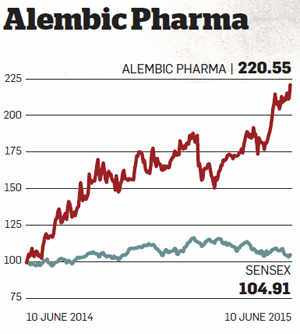

ALEMBIC PHARMA (BUY)

Despite a huge rally in the counter (share price almost doubled in the past year), analysts remain bullish on Alembic Pharma. Successful transformation of its domestic branded business from slow-growing acute therapies to fast-growing speciality segments, a strong base for US generics with 68 Abbreviated New Drug Application (ANDA) filings, growing free-cash flows, a strong balance sheet and return ratios, etc are the reasons behind it.

However, please note that this fast growing stock is not cheap (the current P/E is 37). "The high PE is justified considering the consistently strong growth momentum, healthy business model and robust financial strength," says a recently published research report from Anand Rathi.

|

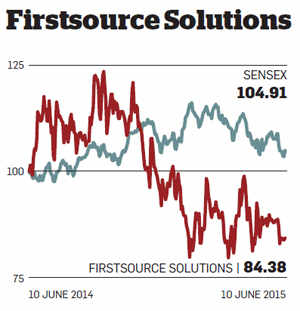

FIRSTSOURCE SOLUTIONS (BUY)

Though Firstsource Solutions is reporting lacklustre growth at the topline level, its net profit has been on the upswing for the last several years as the management concentrates on 'quality growth'. The company is focusing on clients with higher margins and is bargaining hard with clients with low margin now (even discarding them if they are ready to offer reasonable margins). The management is planning to implement this 'quality growth' in 2015-16 as well and this may result in another 10% cut in domestic revenues.Though this may result in an overall topline growth of around 7% in 2015-16, its margin profile will improve further and this will help it to show higher operating profit growth than revenue growth. Cutting down excess staff, repaying high cost debt, etc will help the company show better net profit.

"Operationally, Firstsource Solutions appears to be doing everything right from consolidating facilities, eliminating operational silos, realigning sales function, renegotiating unviable accounts, repaying debt, trimming excess flab, etc. We estimate Firstsource Solutions will report annualised earnings growth of 23% between 2014-15 and 2016-17," says Pankaj Pandey, Head of Research, ICICI Direct. Since this counter is now available at a P/E of 8.35, it is a very good long term bet.

|

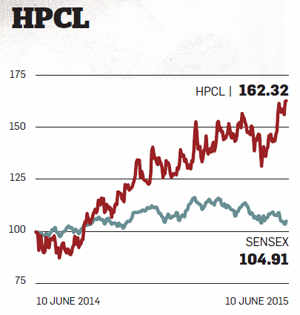

HPCL (BUY)

HPCL beat street expectations in the fourth quarter of 2014-15 by reporting a net profit growth of 25% compared to the same period last year. It was driven by improvement in refining and higher marketing margins. With international crude prices stabilising, there was no hit from inventory losses for HPCL in this quarter. The total quantity of crude processed also increased by 12% from previous quarter (on q-o-q basis), driven largely by output from the Visakh refinery. Since diesel price revisions happen regularly now, marketing margins are also on the upswing.As international crude price is expected to remain subdued (between $50 and $80), more products may go out of the subsidy regime in the coming years. "With lower oil prices likely to lead to quicker reduction in subsidy losses, and also support a gradual expansion in margins, we see HPCL as continuing to remain well placed. Unlocking value from infrastructure assets could provide further upside," says a recently published J P Morgan report.

Though the fear of regulatory hurdles remain (the government may re-impose restrictions if oil prices flare up), the current valuation (P/E of 8.64) more than factors in this. Long term investors should not let go of this counter now.

|

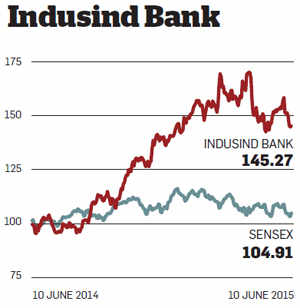

INDUSIND BANK (HOLD)

With over 800 branches, IndusInd Bank is growing fast. The high growth is derived from its high asset quality, low operating costs, low funding costs and high switching costs developed from cross-selling other products and high fee income. "IndusInd Bank's provisions as a percentage of loans averaged 80 basis points over the past five years and is better than HDFC Bank's 1.0% and Axis Bank's 1.1% over the same period," says Suruchi Jain, Equity Research Analyst, Morningstar Investment Adviser. Its fee income growth has been ahead of loan growth.But at four times its book value, it is not quoting cheap now. There is also doubt whether this small bank will able to maintain its quality once it becomes big. The current turmoil in the market is another reason why new investors should wait for a lower price.

|

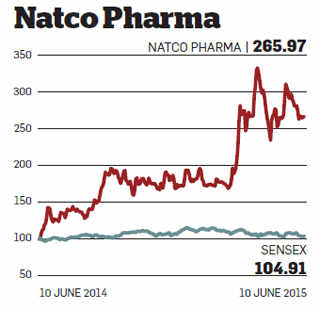

NATCO PHARMA (HOLD)

Natco Pharma is a leading player in the domestic oncology segment with a basket of around 18 products. The current domestic growth is flat, but should witness good traction in coming years on account of new launches. A new avenue for new launches opened up because of the recent judgement on compulsory licensing. A court granted compulsory license to Natco Pharma to manufacture generic version of the drug Nexavar thereby breaking Bayer's monopoly.To compensate slow domestic growth, Natco is concentrating on the US market. Despite being a late entrant, Natco has already created its own identity there for niche products. It has already filed more than 35 ANDAs. "We expect scores of important approvals and launches in the coming 18-24 months," says Pandey. Though the company is expected to grow fast, most of this news is already priced in (P/E multiple of 51.74 explains this).

|

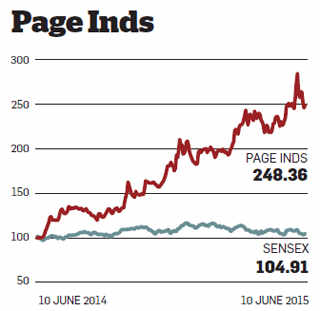

PAGE INDUSTRIES (HOLD)

This innerwear maker's relentless growth is expected to continue in the coming years as well. This 'high margin' company is trying to improve its margin further. It was able to increase the average realisation price by annualised 13% over the last five years through the introduction of premium products under the Jockey brand. Sales and net profit growth should continue, driven by market share gains and new product launches.It can also boast of high return ratios now. "Page Industries has maintained higher than industry average return ratios of around 50%, which we expect to sustain," says Pandey. However, most of these positives are already in the price (the current P/E is at 82.91).

|

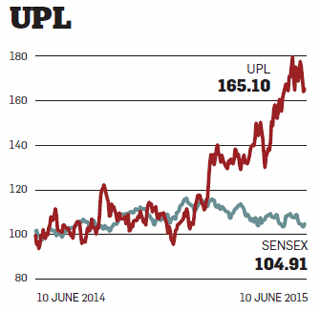

UPL (BUY)

Formerly United Phosphorous, this company is into agrochemicals. It has been reporting solid revenue and earnings growth in the last few years by maintaining its market share in a highly competitive environment. Its net profit is expected to grow by 24% in 2015-16. UPLcontinued with its upward journey despite a warning of below average monsoon and also the recent correction in the broader market.This is because only around 20% of its revenue comes from India. The company reported high growth despite a below average monsoon last year. In fact, a bad monsoon may even help UPL. "UPL is mostly into generic solutions and therefore, any downtrading by farmers due to bad monsoon will help it," says Sumant Kumar, Analyst at Elara Securities. Long term investors need not worry about its valuation as this high growth company is still reasonably priced (P/E of 19.98).

|

No comments:

Post a Comment