Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Visit http://indiaer.blogspot.com/ for complete details �� ��

Home loan consumers shouldn't rejoice yet expecting a cut in their home loan rates, feels Harsh Roongta, CEO, Apnapaisa.com, a day after the banking regulator Reserve Bank of India cut the repo rate by 0.5 per cent.

RBI surprised everybody by decreasing the repo rates (overnight interest rates that commercial banks pay to the Reserve Bank of India for borrowing money) by a full 50 basis points (0.5 per cent).

Naturally most existing home loan consumers think that this will automatically mean lower equated monthly installments,EMIs, for them. But will home loan lenders oblige?

The credit policy can definitely mean lower EMIs for existing home loan consumers but may not be in the way that they think.

Contrary to popular opinion a decrease in repo rates does not automatically translate into decrease in loan rates. Of course the consumers can be forgiven for forming this erroneous opinion that home loan interest rates are automatically linked to repo rates because in the past three years the interest rates have mostly always gone up in line with increases in repo rates by RBI.

So obviously borrowers have a legitimate expectation that interest rates on their existing and new home loan borrowings will decrease now that RBI has bought down the repo rate by an unexpected 50 basis points (The general expectation was a 25 basis point cut in repo rate).

But this expectation may not be fulfilled.

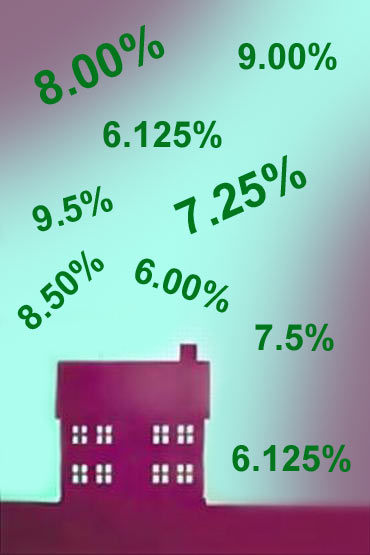

We may see banks announce some token interest rates cuts on home loans but the cuts are likely to come from decreasing spreads over the base rate rather than a drop in base rates themselves.

In plain English it means that only new home loan consumers are likely to benefit from this decrease rather than the existing consumers.

There is another provision in the policy however that is likely to benefit existing home loan consumers if they are willing to be a little pro-active.

After waiting for the banks to adopt the policy voluntarily (banks like Axis, ICICI and SBI did do so) RBI has, at last, decided to issue mandatory guidelines abolishing pre-payment charges on all floating rate home loans.

Readers will be aware that National Housing Bank (NHB) had already taken this step quite some time back and so as far as floating rate home loans are concerned pre-payment charges are now history whether the lender is a housing finance company (HDFC, LIC Housing Finance, etc) or a bank (Axis, Citibank, ICICI, HSBC SBI, Standard Chartered, etc).

Most existing floating rate customers are paying anywhere between 11.5 per cent to 15 per cent interest rates on their home loans versus the 10.5 per cent to 10.75 per cent being charged to new consumers by the same lenders.

If you request them they will drop the interest rates for you too.

But don't expect them to drop interest rates without your asking for the reduction. So get rid of your inertia and demand the lower interest rates from your existing lender.

And if they don't give it to you just shift your loan. You don't need to do any fancy calculations. With pre-payment charges gone and processing fees being very nominal it will make sense to switch your home loan lender if you are paying anywhere more than 10.75 per cent.

The other fallout of the credit policy is that we are likely to see an attempt to drop deposit rates.

The scope for cutting deposit rates is rather limited given the lower than expected growth rates in bank deposits and the fact that the interest rates on small savings instruments such as time and recurring deposits from post offices as well NSC and senior citizen saving schemes as well as PPF have been fixed at a fairly high rate for this financial year.

If sufficient deposits do come in at the reduced rates we might get to see a reduction in base rates as well.

But the process is not a quick one and will take some time. If inflation is not controlled the decrease in base rates may not take place in the near future.

I hope I am proven wrong but meanwhile brace yourself for a rough ride and ensure that you are not paying anything more than you need to.

No comments:

Post a Comment