Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

SUZLON ENERGY LTD

PRICE: RS.18 RECOMMENDATION: REDUCE

TARGET PRICE: RS.20 FY13E P/E: 6.0X

q Depreciating INR trend likely to magnify FCCB liability of the company;

further renegotiation of FCCB conversion price seems unlikely. FCCB conversion

price stands at significantly higher level than the current market

price.

q Competition has been intensifying in wind energy space globally mainly

from Chinese players. Pricing pressure exists across the value chain; from

suppliers to project management companies.

q Order intake in Suzlon wind remains sluggish. Company's order book at

the end of 1HFY12 stands at 2042 MW (ex-RE Power) vis-à-vis our breakeven

level estimate of 1900 MW.

q We reduce our earnings estimate for FY13 to factor in margin pressure

on account of 1) higher raw material pressure 2) lower realizations 3)

higher finance charges for FY12.

q We expect further de-rating of the sector and the company due to 1)

slack in overall business activity in wind energy space globally 2) government

in European region likely to remain reluctant in providing subsidy

and tax incentives due to their already stretched fiscal deficits 3) higher

debt levels of the company.

q We continue to remain cautious on company's stock and maintain our

'Reduce' rating on with one year forward revised target price of Rs 20 (Rs

43 earlier).

Competition has been intensifying in wind energy space globally;

aggressive price cuts from Chinese players and regulatory

uncertainty in key European and US markets adds up to further

Industry woes

n Competition has been intensifying in wind energy space globally mainly driven

by lower prices quoted by Chinese turbine players.

n USA, which is considered as second largest wind market after Europe, has been

observing maximum pricing pressure. Pricing pressure exists across entire value

chain viz. from suppliers to project management companies.

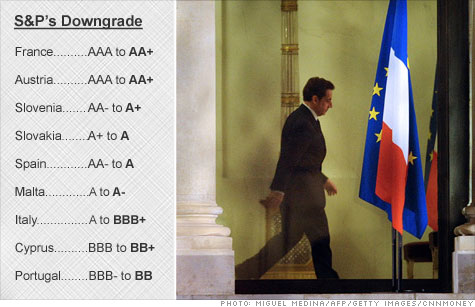

n Business outlook in European region appears sluggish and fresh order bookings

remained elusive in 1HFY12. Government of various countries within EU is reluctant

in dealing with subsidy and tax incentives issues due to their stretched fiscal

deficits position.

n Suzlon claims that the introduction of REC's and other such incentives are likely

to provide thrust to the domestic wind market. However, we believe that this

would be achievable in longer term after things get materialized in terms of policies

and infrastructure.

n Domestic wind industry has been observing a lot of action from the internationals

players like Gamessa and GE trying to gain market share in India posing a threat

to Suzlon that currently enjoys dominant position locally.

Visit http://indiaer.blogspot.com/ for complete details �� ��

SUZLON ENERGY LTD

PRICE: RS.18 RECOMMENDATION: REDUCE

TARGET PRICE: RS.20 FY13E P/E: 6.0X

q Depreciating INR trend likely to magnify FCCB liability of the company;

further renegotiation of FCCB conversion price seems unlikely. FCCB conversion

price stands at significantly higher level than the current market

price.

q Competition has been intensifying in wind energy space globally mainly

from Chinese players. Pricing pressure exists across the value chain; from

suppliers to project management companies.

q Order intake in Suzlon wind remains sluggish. Company's order book at

the end of 1HFY12 stands at 2042 MW (ex-RE Power) vis-à-vis our breakeven

level estimate of 1900 MW.

q We reduce our earnings estimate for FY13 to factor in margin pressure

on account of 1) higher raw material pressure 2) lower realizations 3)

higher finance charges for FY12.

q We expect further de-rating of the sector and the company due to 1)

slack in overall business activity in wind energy space globally 2) government

in European region likely to remain reluctant in providing subsidy

and tax incentives due to their already stretched fiscal deficits 3) higher

debt levels of the company.

q We continue to remain cautious on company's stock and maintain our

'Reduce' rating on with one year forward revised target price of Rs 20 (Rs

43 earlier).

Competition has been intensifying in wind energy space globally;

aggressive price cuts from Chinese players and regulatory

uncertainty in key European and US markets adds up to further

Industry woes

n Competition has been intensifying in wind energy space globally mainly driven

by lower prices quoted by Chinese turbine players.

n USA, which is considered as second largest wind market after Europe, has been

observing maximum pricing pressure. Pricing pressure exists across entire value

chain viz. from suppliers to project management companies.

n Business outlook in European region appears sluggish and fresh order bookings

remained elusive in 1HFY12. Government of various countries within EU is reluctant

in dealing with subsidy and tax incentives issues due to their stretched fiscal

deficits position.

n Suzlon claims that the introduction of REC's and other such incentives are likely

to provide thrust to the domestic wind market. However, we believe that this

would be achievable in longer term after things get materialized in terms of policies

and infrastructure.

n Domestic wind industry has been observing a lot of action from the internationals

players like Gamessa and GE trying to gain market share in India posing a threat

to Suzlon that currently enjoys dominant position locally.