Please Share::  India Equity Research Reports, IPO and Stock News

India Equity Research Reports, IPO and Stock News

Visit http://indiaer.blogspot.com/ for complete details �� ��

Visit http://indiaer.blogspot.com/ for complete details �� ��

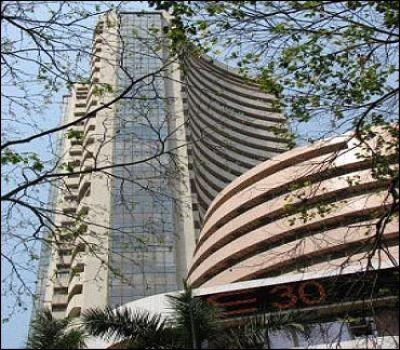

Credit rating agency Crisil on Wednesday said depreciation in the rupee will shave off up to Rs 4,000 crore (Rs 40 billion) from the profits of Nifty companies in the December quarter.

"Because of a further 8 per cent depreciation of the rupee against the dollar in this quarter, companies are likely to report further foreign exchange losses of Rs 3,500 (Rs 35 billion) to 4,000 crore (Rs 40 billion) in the quarter," Crisil head for industry and customised research, Prasad Koparkar said in a report.

The agency said that even in the July-September quarter, 42 of the 50 companies on the National Stock Exchange's index Nifty lost Rs 4,800 crore (Rs 48 billion) or close to 8 per cent of their profits before taxes due to the rupee's fall.

The rupee has been one of the worst performing currencies globally, having ceded around 18 per cent to the US dollar since August.

As the concerns mount, the Reserve Bank had to intervene in the market by selling part of its $300 billion reserves to curb the volatility, besides clamping down on traders.

"Demand for the dollar increased due to repayment pressures on private foreign debts and the rising import bill.

"But supply failed to keep pace as foreign inflows dwindled due to rising risks in the Eurozone.

"The resultant mismatch led to the sharp fall of the rupee," the agency's chief economist Dharmakirti Joshi said.

The companies' profits will get dented due to the high level of foreign debt on its books, Crisil said in a note, adding the cumulative foreign currency debt is an estimated Rs 1.5 trillion or about 24 per cent of their total outstanding.

Sectors like oil refining and marketing, telecom and steel, which have a fourth of their debt in foreign currency, are likely to get affected, it said.

For crude oil import dependent oil refining sector, the troubles will be compounded, it added.

In contrast, export-oriented sectors like IT and pharma, which also have low debt levels, are expected to gain from the rupee depreciation, Crisil said.